You know that feeling when payday arrives and somehow the money just... disappears?

You're not overspending on anything obvious. No luxury purchases. No expensive habits.

But at the end of the month, your bank account tells a different story.

Where did it all go?

This is where most budgeting apps fail you. They track numbers automatically, show you charts and graphs, but they don't create the awareness that actually changes behavior.

Enter Kakeibo (pronounced "kah-keh-boh") — a 120-year-old Japanese budgeting method that takes a completely different approach.

Instead of automation, Kakeibo uses mindfulness. Instead of restriction, it uses reflection. Instead of complex systems, it uses four simple categories.

And here's what makes it powerful: studies show people who manually track expenses save 20-35% more than those using automated tools.

In this guide, I'll show you exactly how Kakeibo works, why it's so effective, and how you can start using it today to transform your relationship with money.

What Is the Kakeibo Method?

Kakeibo literally means "household finance ledger" in Japanese.

It was created in 1904 by Motoko Hani, Japan's first female journalist, who wanted to help women manage household finances more effectively.

But Kakeibo isn't just about tracking expenses. It's about understanding WHY you spend the way you do.

Before every purchase, Kakeibo asks you to pause and reflect:

- Do I really need this?

- Can I live without it?

- Will I actually use it?

- Do I have the space for it?

- What is my emotional state right now?

This simple pause creates awareness. And awareness is what changes behavior.

The 4 Kakeibo Spending Categories

Unlike traditional budgets with dozens of categories, Kakeibo uses just four:

1. NEEDS (Survival Expenses)

Essential expenses you cannot avoid:

- Rent or mortgage

- Utilities (electricity, water, internet)

- Groceries

- Transportation

- Insurance

- Minimum debt payments

2. WANTS (Optional Expenses)

Things that make life enjoyable but aren't essential:

- Dining out

- Entertainment (movies, concerts)

- Shopping (clothes, gadgets)

- Subscriptions (streaming services)

- Hobbies

3. CULTURE (Personal Growth)

Investments in yourself and your knowledge:

- Books

- Online courses

- Workshops and seminars

- Museum visits

- Educational experiences

4. UNEXPECTED (Surprises)

Expenses you didn't plan for:

- Medical emergencies

- Car repairs

- Home maintenance

- Gifts for unexpected occasions

- Emergency replacements

This categorization helps you see patterns. Maybe you're spending too much on WANTS. Or perhaps you're neglecting CULTURE (personal growth). The awareness alone drives better decisions.

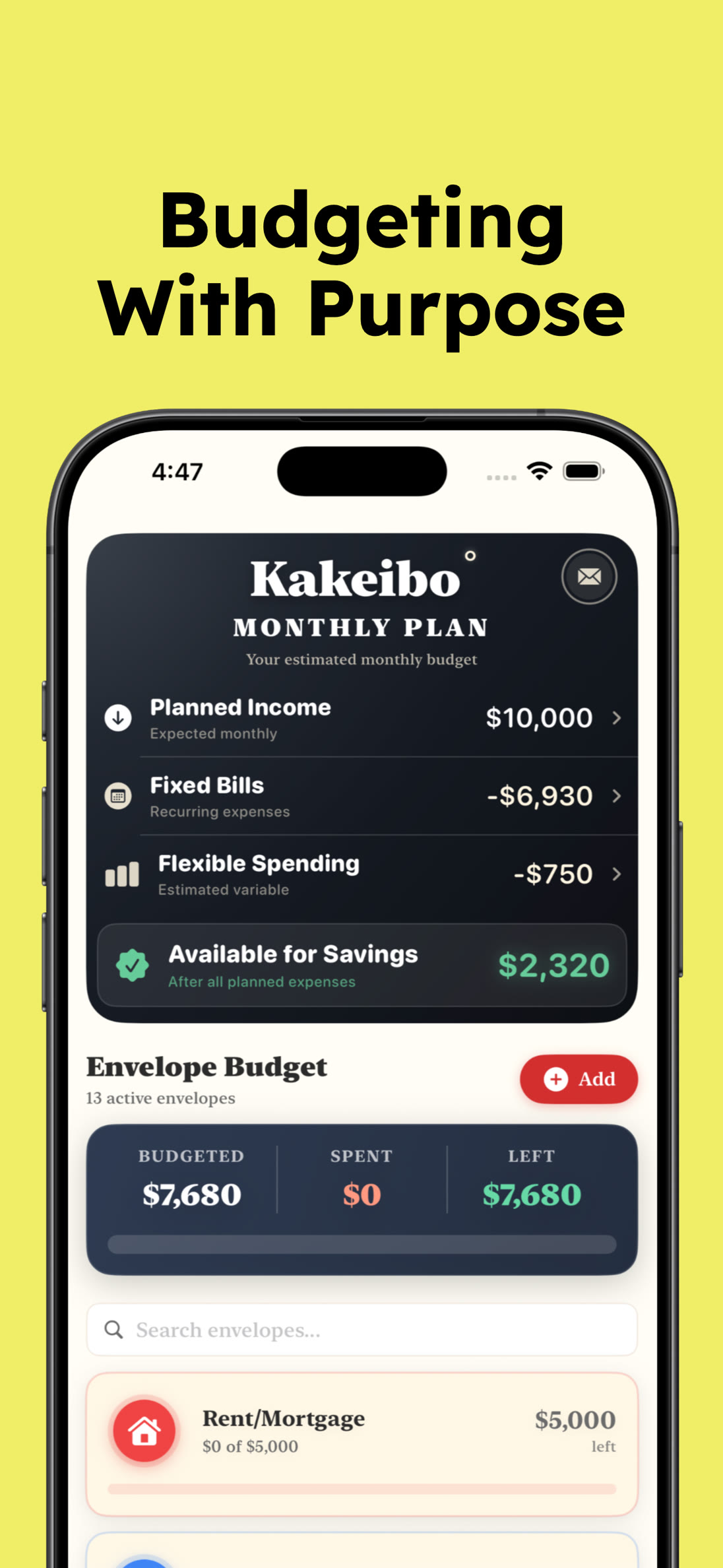

How Kakeibo Works: The Complete System

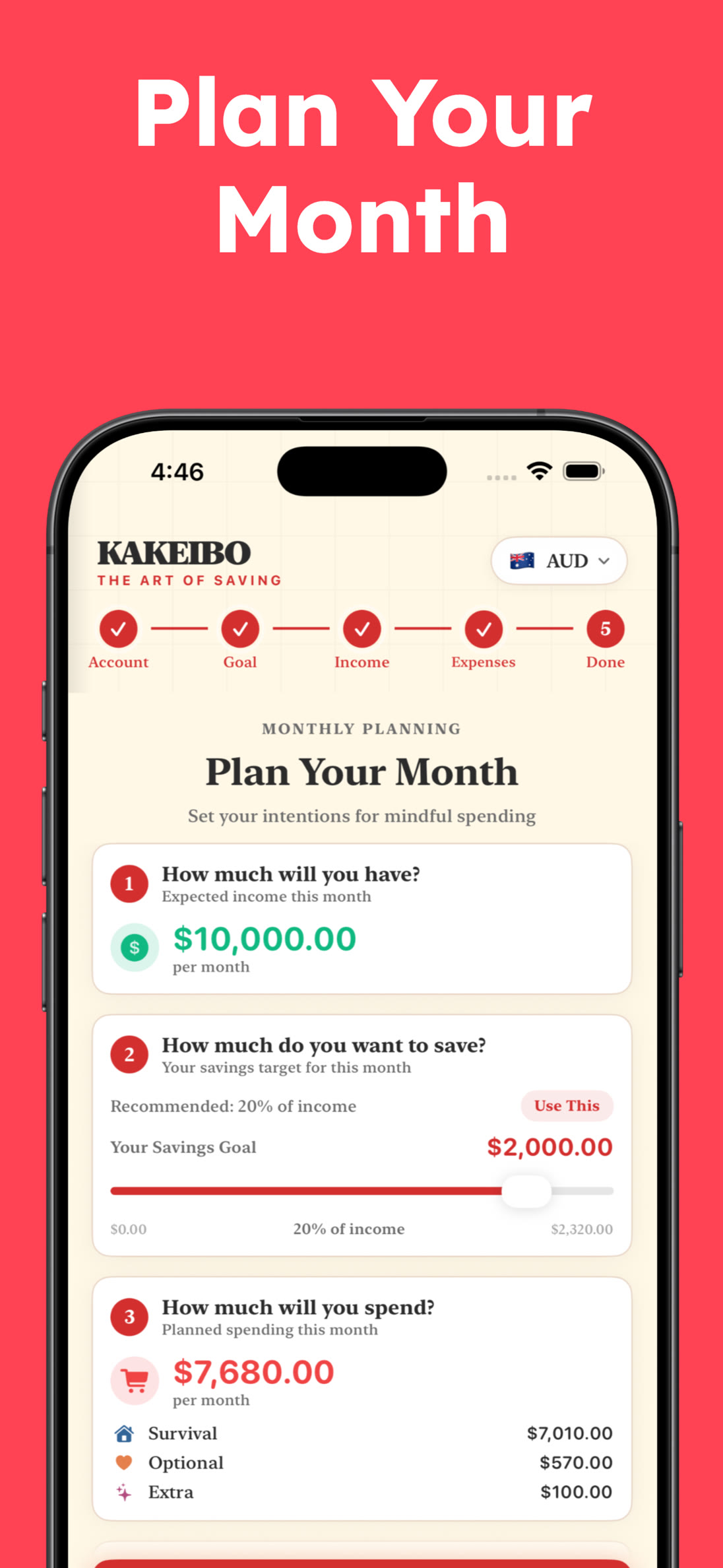

Step 1: Monthly Planning

At the start of each month, you answer these questions:

- How much money do I have available? (Total income for the month)

- How much do I want to save? (Set a specific savings goal)

- How much do I need for fixed expenses? (Rent, bills, insurance)

- How much can I spend? (What's left after savings and fixed costs)

This planning phase sets clear intentions. You're not just hoping to save — you're committing to a specific amount upfront.

Step 2: Daily Expense Tracking

Here's where Kakeibo differs from automated apps.

You manually log every single expense. Every coffee. Every meal. Every purchase.

Why manual tracking?

Because the act of writing creates awareness. When you physically record "$6.50 for coffee," you're forced to acknowledge the expense. This creates an emotional connection to your spending that automated tracking never achieves.

For each expense, you note:

- The amount

- What it was for

- Which category (Needs, Wants, Culture, Unexpected)

- Optional: Why you bought it / how you felt

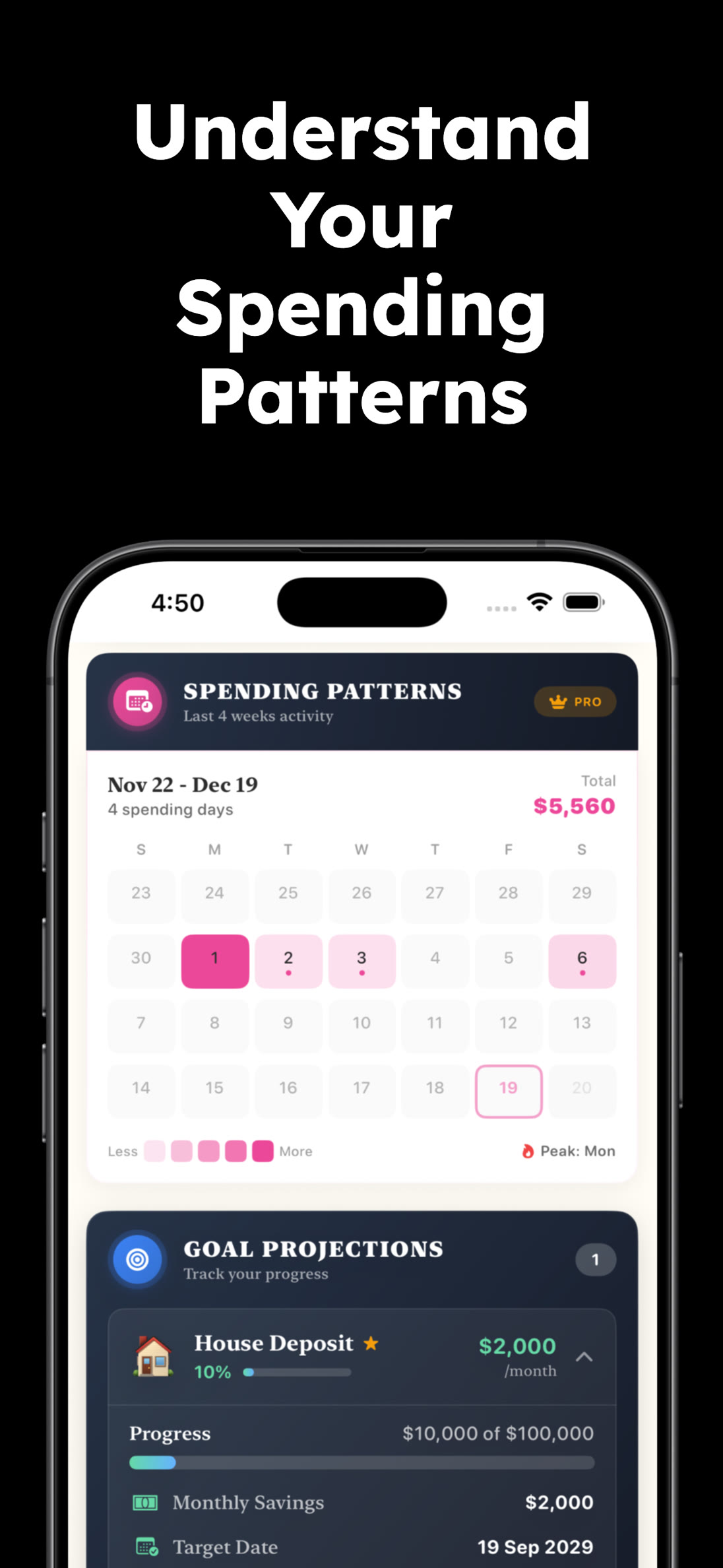

Step 3: Weekly Check-ins

Every week, review your spending:

- Where did most money go?

- Any surprises or patterns?

- Are you on track for your savings goal?

- What can you adjust for next week?

These weekly reviews keep you accountable without waiting until month's end when it's too late to course-correct.

Step 4: Monthly Reflection

At month's end, Kakeibo asks powerful reflection questions:

- Did I reach my savings goal? If not, why not?

- What worked well this month? Celebrate wins!

- What could I improve? Identify specific changes

- What unexpected expenses came up? Can I plan for them next month?

- How do I feel about my spending? Emotional awareness matters

This reflection is where real wisdom develops. You're not just tracking numbers — you're understanding your relationship with money.

Ready to Master Kakeibo Budgeting?

Download our Kakeibo app and start your journey to mindful money management today

Get Started FreeWhy Kakeibo Works: The Science Behind It

1. Manual Tracking Creates Awareness

Research from the Journal of Financial Planning shows that people who manually record expenses are more conscious of their spending patterns and make better financial decisions.

When you write "$12 for lunch," your brain processes this differently than seeing it auto-categorized in an app. The physical act creates a stronger memory and emotional connection.

2. Reflection Builds Wisdom

Kakeibo's monthly reflection questions aren't just feel-good exercises. They're designed to build financial self-awareness.

By repeatedly asking "Why did I spend this?" and "How do I feel about this purchase?" you develop a deeper understanding of your spending triggers.

Maybe you shop when stressed. Or overspend on weekends. This awareness is the first step to change.

3. Categorization Reveals Patterns

The four Kakeibo categories make patterns obvious.

When you see that 60% of your spending goes to WANTS, you can't ignore it. The visual representation forces honesty about your priorities.

4. Intention Before Action

Setting a savings goal at month's start creates intentionality. You're not trying to save "whatever's left" — you're committing to a specific amount upfront.

This psychological shift dramatically increases success rates.

Kakeibo vs Traditional Budget Apps

Let's be real about the difference:

Traditional Budget Apps:

- Automatically categorize transactions

- Show you charts and graphs

- Track everything passively

- Focus on numbers, not behavior

- Zero reflection required

Kakeibo Method:

- Manual entry creates awareness

- Simple four-category system

- Weekly and monthly reflection

- Focuses on WHY you spend

- Builds mindful spending habits

The best approach? Combine both. Use a digital Kakeibo app that preserves the method's mindfulness while adding modern convenience.

How to Start Using Kakeibo Today

Ready to begin? Here's your action plan:

Week 1: Setup and Planning

- Calculate your monthly income (all sources)

- List your fixed expenses (rent, utilities, insurance)

- Set a realistic savings goal (start with 10-15% if new to budgeting)

- Calculate your "safe to spend" amount

- Download a Kakeibo app or buy a physical journal

Week 2-4: Daily Tracking

- Log every single expense within 24 hours

- Categorize each expense (Needs, Wants, Culture, Unexpected)

- Add a brief note about why you made the purchase

- Do a quick weekly review every Sunday

End of Month 1: First Reflection

- Compare actual spending to your plan

- Calculate how much you saved

- Identify your biggest spending category

- Answer the monthly reflection questions honestly

- Set goals for month 2 based on what you learned

Common Kakeibo Mistakes (And How to Avoid Them)

Mistake #1: Setting Unrealistic Savings Goals

Solution: Start with 10-15% of income. As you get better at managing money, gradually increase to 20-30%.

Mistake #2: Forgetting to Track Small Purchases

Solution: Those $3 coffees and $8 snacks add up to hundreds monthly. Track everything, no matter how small.

Mistake #3: Skipping Weekly Reviews

Solution: Set a recurring calendar reminder. Weekly reviews take 10 minutes but prevent month-end surprises.

Mistake #4: Being Too Hard on Yourself

Solution: Kakeibo is about progress, not perfection. If you overspend one month, use it as data for next month's improvements.

Mistake #5: Not Adjusting Categories

Solution: Your spending will change. Adjust your category allocations monthly based on real data, not guesses.

Advanced Kakeibo Strategies

Strategy 1: The 24-Hour Rule

For any non-essential purchase over $50, wait 24 hours before buying. This pause often reveals impulse purchases you don't actually want.

Strategy 2: Category Envelopes

Allocate specific amounts to each Kakeibo category at month's start. When a category envelope is empty, you're done spending in that area.

Strategy 3: Automate Savings First

Transfer your savings goal amount to a separate account on payday. You can't spend what you don't see.

Strategy 4: Visualize Progress

Track your savings growth with charts or visual progress bars. Seeing your money grow is motivating.

Strategy 5: Monthly "No-Spend" Challenges

Pick one category (usually WANTS) and challenge yourself to a no-spend week or month. This resets your relationship with that spending area.

💡 Pro Tip: The average Kakeibo user who consistently tracks expenses and does monthly reflections saves 25% more within the first 6 months compared to their previous budgeting attempts.

Real Results from Kakeibo Users

Sarah, 29, Marketing Manager:

"I tried every budget app out there. Nothing stuck. Kakeibo was different because it made me think about WHY I was spending, not just WHAT. After 3 months, I saved $2,400 I would have mindlessly spent on dining out and shopping. That money went toward my emergency fund."

Michael, 35, Software Engineer:

"The weekly check-ins are game-changers. Instead of discovering at month's end that I overspent, I catch it early and adjust. I've increased my savings rate from 10% to 28% in just 8 months."

Lisa & Tom, Couple in Their 40s:

"Kakeibo helped us get on the same page about money. The monthly reflection questions sparked conversations we'd been avoiding for years. We paid off $15,000 in credit card debt in 18 months using this method."

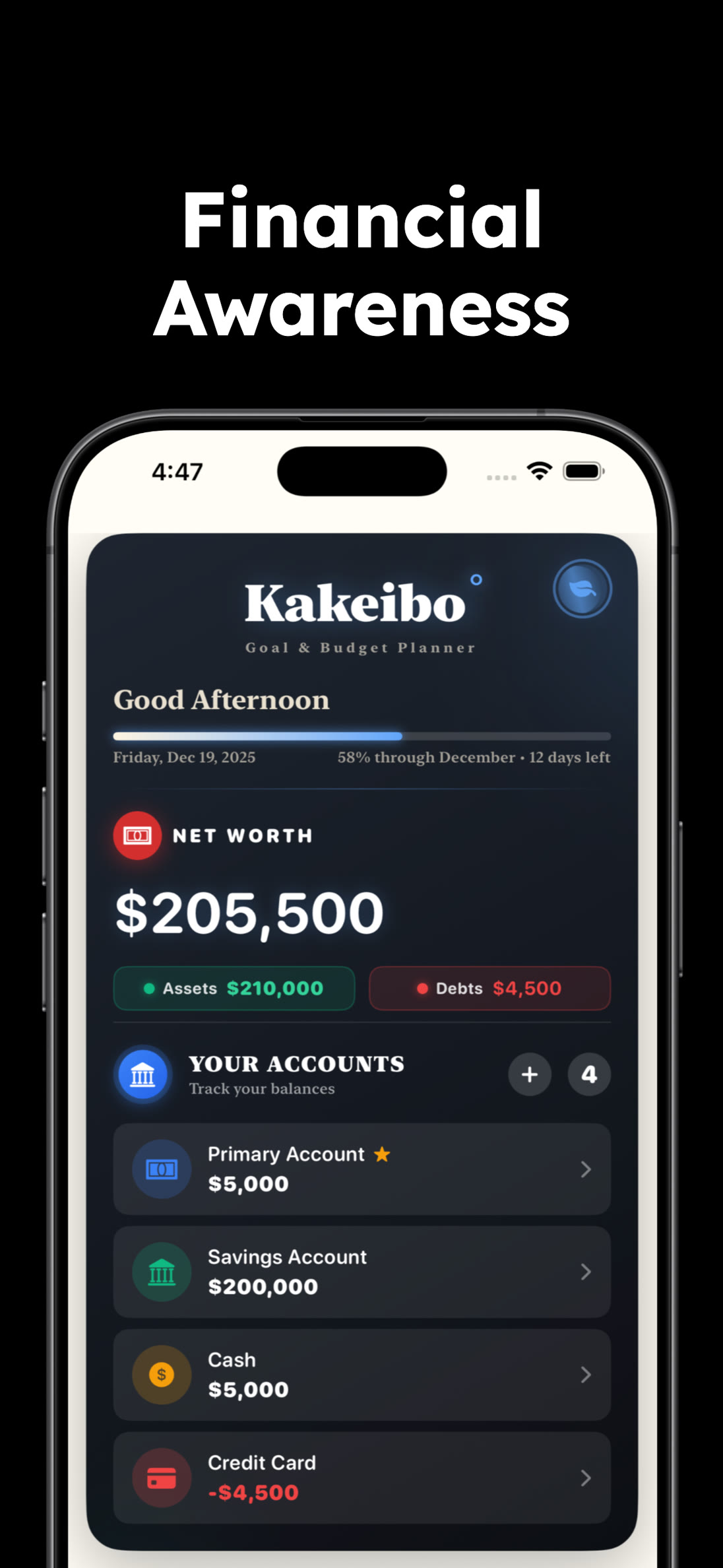

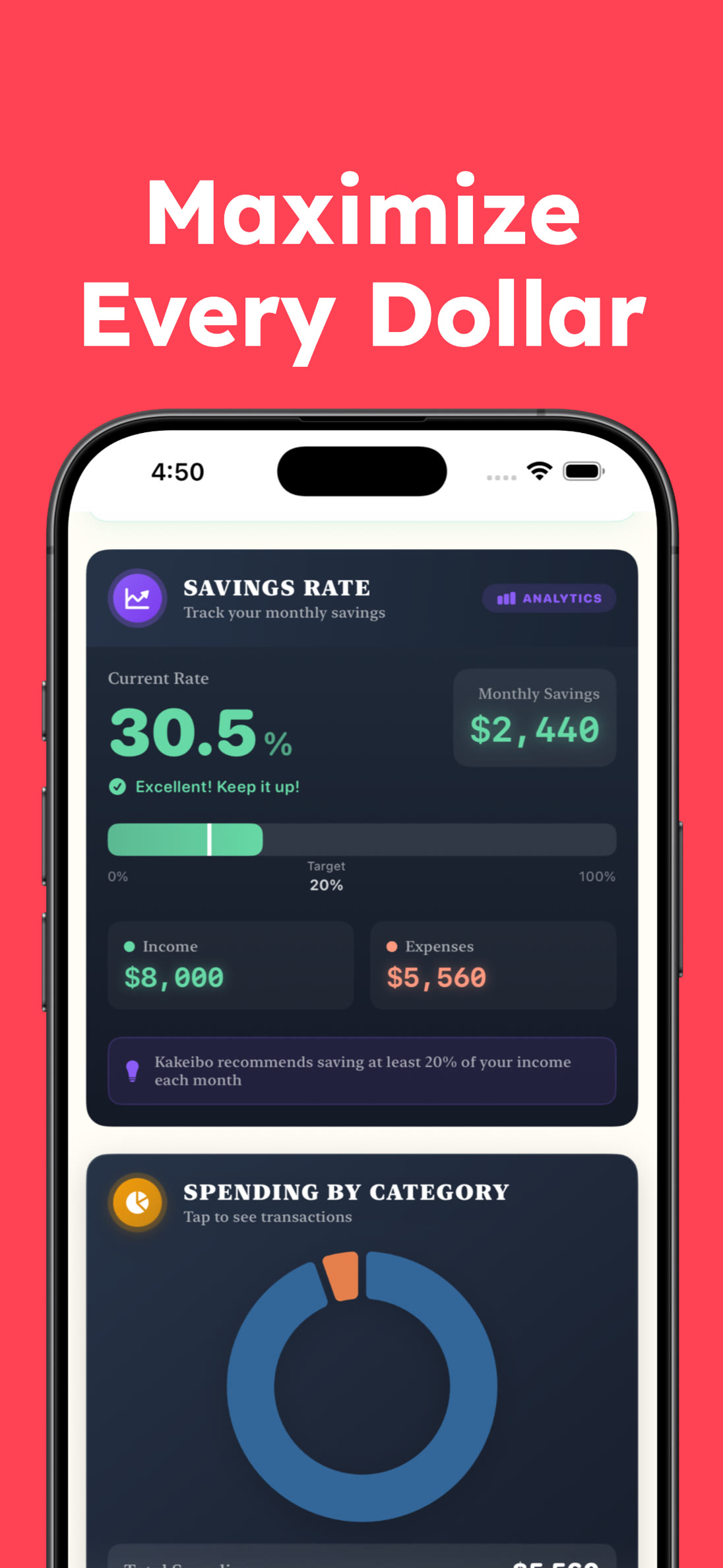

Using Digital Kakeibo Apps

While traditional Kakeibo uses a physical journal, modern digital apps bring the method to your iPhone or iPad with added benefits:

📱 Always With You

Track expenses immediately, anywhere. No need to carry a notebook.

📊 Automatic Calculations

The app does the math while you focus on reflection and awareness.

🔔 Gentle Reminders

Weekly check-in reminders and monthly reflection prompts keep you consistent.

📈 Visual Progress

See your savings grow with beautiful charts and milestone celebrations.

🔒 Privacy First

Your financial data stays on your device. No cloud syncing, no data selling.

✈️ Multi-Currency

Perfect for travelers and expats tracking expenses in multiple currencies.

The Kakeibo app for iOS combines the proven Japanese method with modern convenience, helping you build mindful spending habits without sacrificing ease of use.

Transform Your Finances with Kakeibo

Join thousands of users saving 20-35% more through mindful budgeting

Download Free for iOSFrequently Asked Questions

Start Your Kakeibo Journey Today

Here's what we've covered:

Kakeibo is a 120-year-old Japanese budgeting method that helps you save 20-35% more through mindful spending, manual tracking, and monthly reflection.

Unlike automated budget apps that just track numbers, Kakeibo creates awareness of WHY you spend the way you do.

The four categories (Needs, Wants, Culture, Unexpected) make spending patterns obvious. The weekly check-ins keep you accountable. The monthly reflections build lasting financial wisdom.

This isn't about restriction or deprivation. It's about intention and awareness.

When you understand your spending patterns and motivations, you naturally make better decisions. You spend on what truly matters and cut what doesn't.

The result? More savings. Less financial stress. Greater peace of mind.

Thousands of people have transformed their finances with Kakeibo. Your turn.

Download the Kakeibo app for iOS and start your first month today. Set your savings goal. Track your expenses. Do your weekly reviews. Complete your first monthly reflection.

In 30 days, you'll have more financial awareness than you've ever had. In 90 days, you'll have new spending habits. In 6 months, you'll wonder why you didn't start sooner.

Your financial transformation begins with a single decision: to become aware of where your money goes and why.

Make that decision today.